Briefly Explain the Differences Between Hedging and Arbitrage

This type of strategy involves a large position in a security that is traded in. It is a financial strategy used by tradersinvestors to mitigate the risk of losses that may occur due to unexpected fluctuation in the market.

Shriya Patwari Shriyapatwari1 Twitter

Arbitrage involves limited risk.

. In fact arbitrage is a popular trading technique. A Define the meaning of underwriting. Explain in detail the difference between hedging speculation and arbitrage.

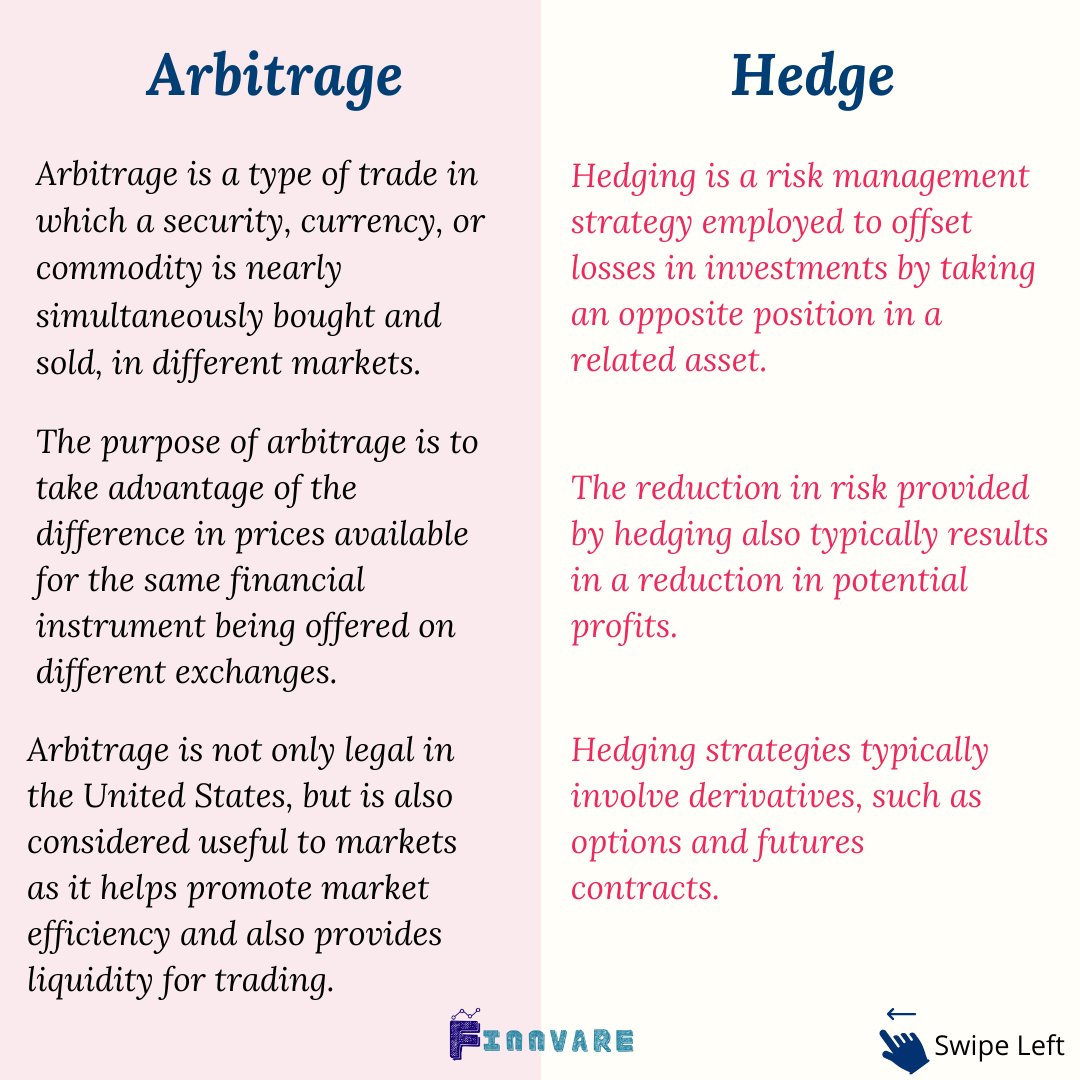

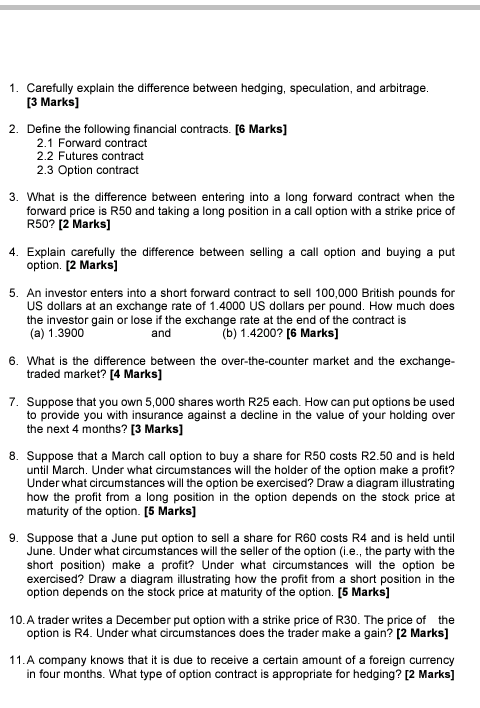

Arbitrage is the simultaneous purchase and sale of equivalent assets at prices which guarantee a fixed profit at the time of the transactions. Explain in detail the difference between hedging speculation and arbitrage. A trader is hedging when she has an exposure to the price of an asset and takes a position in a derivative to offset the exposure.

What is a Hedge A hedge is an investment to reduce the risk of adverse price movements in an asset. Hedging involves the concept of betting short versus betting long in the financial markets. Arbitrage is fairly common among institutional investors and hedge funds and comes with a limited amount of risk.

It is basically a risk management strategy used for contrary situation. Arbitrage occurs as the result of market inefficiencies and is the practice of buying and selling an asset in different markets at the same time in order to benefit from price difference. Speculation involves high risk.

So Im going to give an example of how you would say this. BREAKING DOWN Hedge Hedging is analogous to. Please answer the following questions.

Arbitrage is usually used by a trader who seeks to make large profits through market inefficiencies. C Identify the major sources of information available 2. B Briefly explain the basic principles of underwriting.

Arbitrage and hedging are both techniques that are used by traders that operate in a volatile financial environment. Usually the two assets are equivalent in all respects except maturity. Speculation is done for profits by taking risks.

Explain carefully the difference between hedging speculation and arbitrage. Short selling is the sale of a security that is not owned by the seller or that the seller has borrowed. Speculation is the purchase or sale of an asset in the expectation of a gain from changes in the price of that asset.

The arbitrage Arbitrage Arbitrage is the strategy of taking advantage of price differences in different markets for the same asset. A Define the meaning of underwriting. For it to take place there must be a situation of at least two equivalent assets with differing prices.

B Briefly explain the basic principles of underwriting. Hedging on the other hand is the act of reducing the risk of potential loss through an offsetting investment. Hedging also involves the use of multiple concurrent bets in the opposite directions with the aim of limiting the risk of serious investment losses.

The concept of Short Selling. In a speculation the trader has no exposure to offset. In arbitrage the investor aims to earn profit from the difference of the market values of an asset whereas in hedging he targets to reduce the loss which he expects to face in the future.

At least 200 words Question. At least 200 words. Arbitrage trading is used by arbitrage traders.

Hedging is the simultaneous purchase and sale of two assets in the expectation of a gain from different subsequent movements in the price of those assets. Hedging is done only to safeguard the portfolio. Difference between speculation and arbitrage.

Normally a hedge consists of taking an offsetting position in a related security such as a futures contract. For centuries there has been a consensus that investing is useful and ought to be encouraged. In essence arbitrage is a situation that a trader can profit from strategy is very simple yet very clever.

Arbitrage is the act of taking advantage of a price difference between two or more geographies. Hedging is done to avoid risk. And these two terms are to describe the stock price movement.

Arbitraging is done for small profits with safetyNISM Moc. Hedging strategy can easily be used for Arbitrage. Hedging speculation and arbitrage are the strategies which investors use to make profits or reduce risks on their investments.

Usually the two assets are equivalent in all respects. Explain carefully the difference between hedging speculation and arbitrage. Basically hedging involves the use of more than one concurrent bet in opposite directions in an attempt to limit the risk of serious investment loss.

Please answer the following questions. The investors can learn a lot about arbitrage and hedging by studying the subject of financial management. Finance questions and answers.

However these techniques are quite different to each other and are used for different purposes. Arbitrage vs Hedging. In trading a hedge fund is a commonly used protection against adverse price.

So bear refers to when the price of stocks go down within a period and the bull market the opposite is when it goes up. Arbitrage involves the concept of buying and selling a product based on the price difference. Custom fortnite skins cheetos mac and cheese bold and cheesy.

Actually the all hedge funds use all these techniques. As nouns the difference between arbitrage and speculation is that arbitrage is the practice of quickly buying and selling foreign currencies in different markets in order to make a profit while speculation is the process of thinking or meditating on a subject. It involves buying a product and.

The risk involved in dealing in the forward foreign exchange market can be covered by activities like hedging speculation and arbitrage. The activities allow the dealers not only to cover the risks involve. So the market after March 2020 has been a.

This practice is prevalent in trading. Hedging is used everywhere but mostly used by hedge funds. Answer 1 of 8.

She is betting on the future movements in the price of the asset. C Identify the major sources of information available 2. Please answer the following questions.

Hedging is the simultaneous purchase and sale of two assets in the expectation of a gain from different subsequent movements in the price of those assets. However the techniques of arbitrage are more profound as compared to hedging.

Differbetween Difference Entre L Arbitrage Et La Speculation

Solved 1 Carefully Explain The Difference Between Hedging Chegg Com

1 A By Using Example S Discuss The Differences Chegg Com

What Is The Difference Between Hedging Speculation And Arbitraging Youtube

No comments for "Briefly Explain the Differences Between Hedging and Arbitrage"

Post a Comment